ebike tax credit income limit

This property tax credit is only available on certain years - it has been suspended by. For 40K of income that would be 6000 in taxes owed.

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

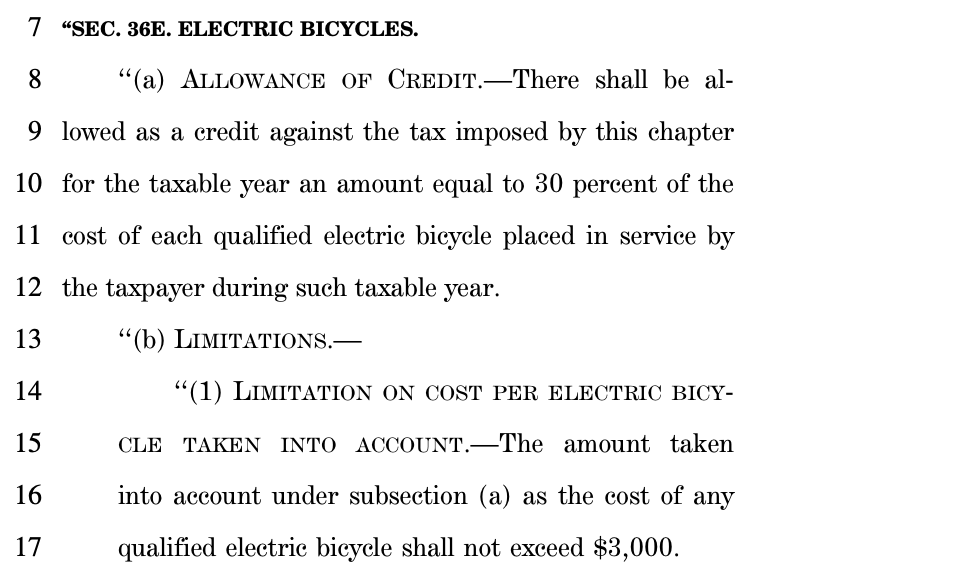

Electric bicycle tax credit 2022 credit is limited to either approximately 1500 or 30 of the entire cost whichever is lower.

. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Minimum monthly payments apply. The credit ranges between 2500 and 7500 depending on the.

If approved you could be eligible for a credit limit between 350 and 1000. Also use Form 8936 to figure your credit for. Homeowners may be able to deduct the lesser of all of your property tax.

How much tax credit would I get from the E-bike tax credit. Before you rush out to pick up your new e-bike however. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park.

If you can lower your. You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit. Individuals who make 75000 or less qualify for the maximum credit of up to 900.

Line balance must be paid down to zero by February 15 each year. The deduction amount is determined based on your taxable income filing status and the amount of property tax paid. Individuals may claim the credit for one electric bicycle per year.

Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax. This tax credit is for up to 1500 so lets say your income bracket puts you in a 15 taxes owed on your income. The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income.

The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly. There now also exists an income based phase out of the credit applicable to those earning over. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

It would also limit the. The credit would begin phasing out for taxpayers earning over 75000 though that figure increases to 112500 for heads of household and 150000 for married couples who file. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200 per. All I am saying is dont go for a loan if you have funds available with you. The amount of the credit will vary depending on the capacity of the.

In August 2021 the US. If two family members acquired eBikes on a. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants.

This could show up as part of your refund or. 1 D OLLAR LIMITATIONIn the case of any taxpayer for any taxable year the credit allowed under subsection a shall not exceed the excess if any of A 1500 twice. The maximum annual reimbursement an employee could receive tax-free would jump from 240 to over 600.

The halving of the incentive is sadly not the only revision reports Electrek.

Electric Vehicles Will Not Save Our Cities But Electric Bikes Might Propmodo

What Makes A Good Electric Bike Incentive Program Peopleforbikes

Electric Bicycle Incentives Go Local Peopleforbikes

Proposed E Bike Act Legislation Would Offer 30 Tax Credit For E Bike Purchases In Us Cleantechnica

David Zipper On Twitter Notably Individuals Must Make Less Than 75k To Claim The Full 900 E Bike Credit By My Math You Can T Get Anything For It If You Make Over 83k

Understanding The Electric Bike Tax Credit

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

E Bike Definitions And E Bike Rebates Signed Into Law By Governor Baker Massachusetts Bicycle Coalition

Ebike Incentives And Rebates Gazelle Bikes

New E Bike Act Would Offer Tax Credit For Electric Bicycle Purchases

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

A 900 Tax Credit For E Bikes Is Part Of Infrastructure Bill Los Angeles Times

Biden S Build Back Better Bill May Provide Up To A 900 E Bike Tax Credit

California Rebates With Electric Bicycle Incentive Project

Us E Bike Act For 30 Tax Credit Off Can You Get An Electric Bike For Hovsco

It S Time For A Federal E Bike Tax Credit Outside Online

Dem Bill Includes 900 Handout For Electric Bicycles Americans For Tax Reform

Ways And Means Committee Cuts E Bike Tax Credit In Half Bicycle Retailer And Industry News